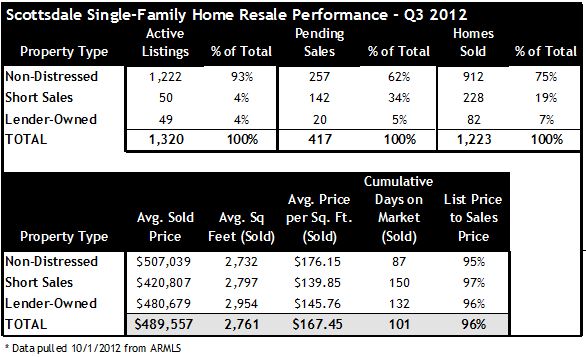

Below are the sales figures for the single-family home market in Scottsdale Arizona in the the third quarter of 2012.

Below are the sales figures for the single-family home market in Scottsdale Arizona in the the third quarter of 2012.

I have broken the information into three categories of home sales and their definitions are below:

– Non-Distressed Sales – These are “traditional” or “typical” sales. In this scenario, the buyer and seller negotiate and no third-party approvals are necessary.

– Short Sales – This is one of the two “distressed” categories. A short sale is where a homeowner needs to sell the home for less than what is owed. You may hear homeowners in this position as “underwater.” In this case, the terms of the contract and sale need to have an approval from any lienholder(s) of the property.

– Foreclosures – This is the other”distressed” category. These are homes that have been through the foreclosure process and no longer belong to the homeowner. Other names for these sales are “Lender-Owned” homes, “REO” homes and/or “Bank-Owned” homes.

Overall Findings for the Q3 2012 Scottsdale Single-Family Home Market – Data As of October 1, 2012

- Scottsdale Homes for Sale: The majority (93%) of homes on the market were “regular” sales. Short sales and foreclosures shared the small balance.

- Scottsdale Pending Home Sales: In comparison, distressed sales made up a much larger portion (39%) of pending home sales, with short sales coming in at 34%. This shows the demand in the market for these properties.

- Q3 2012 Scottsdale Home Sales: Regular sales gained some ground back at the end of the quarter, coming in with 75% of all sales. What is interesting to note is that distressed sales only made up 8% of the for sale market, but accounted for 26% of home sales in the 3rd quarter of 2012.

- Home Prices: As to be expected, regular home sales had the highest average sales price as well as the highest average price per square foot. What is interesting to note, (and is something we have been seeing here and there over the last few quarters), is that short sales have a lower average sales price and price per square foot that foreclosures. Traditionally, foreclosures came much lower on both metrics.

- Days on Market: The cumulative days on market have been improving as the year progresses. As to be expected, regular sales had the shortest time on the market, followed by foreclosures. As we would expect, short sales have the longest time on the market.

- Discounts Off of List Price: As time progresses, we are seeing the discounts off of list price shrink. At the end of the quarter, the average discount for regular homes was 5%. For short sales, it was only 3% and foreclosures came in at 4% off of asking price.

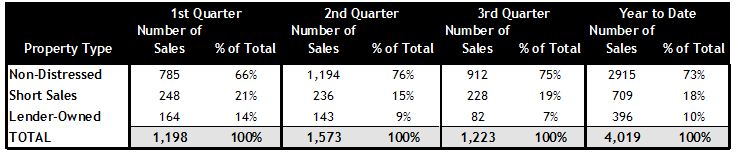

Scottsdale AZ Home Sales Q1 through Q3 2012

Here is a recap of the first three quarters of 2012. As you can see, the impact of distressed properties decreased as the year progressed.

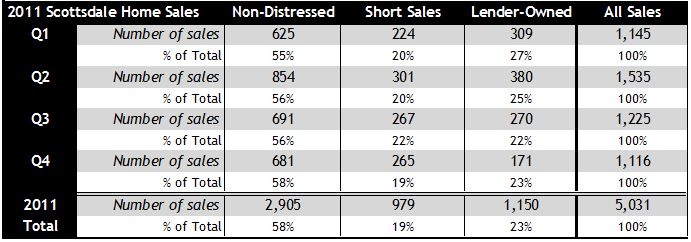

Scottsdale AZ Home Sales 2011

To compare the 2012 results with the numbers from 2011, you can refer to the chart below which shows 2011 home sales by type for Scottsdale.

If you are interested, you can browse through the previous reports for Scottsdale home sales:

View Scottsdale Home Sales by Type for Q2 2012

View Scottsdale Home Sales by Type for Q1 2012

View Scottsdale Home Sales by Type for Q4 2011

View Scottsdale Home Sales by Type for Q3 2011

Disclaimer: Due to rounding issues, not all columns will add up to a perfect 100%. Data and information were pulled from the Arizona Regional MLS (ARMLS) as of 10/1/2012 and can change at any time. The analysis looks at single-family resale homes for sale and sales in Scottsdale AZ on a quarterly basis. There may be new home inventory in these figures if the developer is using the MLS to market its homes. Information deemed reliable but not guaranteed. This post represents the opinion of the author. No warranties express or implied.

Copyright © 2012 Heather Tawes Nelson