Here is a review of Scottsdale Arizona single-family home sales for Q3 2011. The data has been segmented into three categories based on sales type.

The three categories of home sales and how I am defining them are outlined below:

– Non-Distressed Sales – These are the “regular” or “traditional” home sales. In this case, the buyer and seller negotiate directly with each other to come to the terms of the purchase.

– Short Sales – Short sales occur when a homeowner needs to sell his/her home for less than what is owed on it. In this scenario, lender approval is required. Quite often, there are multiple lenders who need to approve the terms of the deal; the primary lienholder (i.e. the lender on the first mortgage) and the second lienholder, who also has a position.

– Foreclosures – These homes have been foreclosed upon and now make up the foreclosure inventory. You might also see these homes called “Lender-Owned” homes, “REO‘” homes or “Bank-Owned” homes.

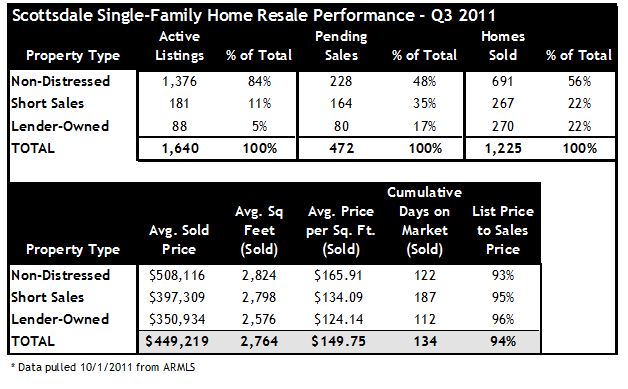

Overall Findings for the Q3 2011 Scottsdale Single-Family Home Market – Data As of October 1, 2011

- Scottsdale Homes for Sale: Regular sales made up the vast majority of the for sale inventory at the end of the quarter with 84%. Short sales came in a distant second and foreclosure inventory was only 5% of the market.

- Scottsdale Pending Home Sales: As we have typically seen, regular sales’ percentage of the market drops off significantly when we look at pending sales. At the end of the quarter, 48% of pending sales were for regular sales, whereas short sales jumped to 35% of the inventory and foreclosures moved up to 17%.

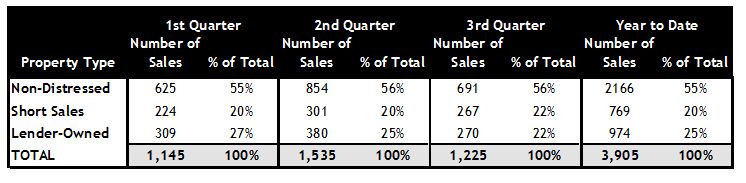

- Q3 2011 Scottsdale Home Sales: Here, the distribution is similar to pending sales, but regular home sales make up a larger portion. As I have pointed out in previous posts, it is interesting to note that foreclosures, with only 5% of the active market, made up 22% of sales in Q3 2011.

- Home Prices: The prices follow what we would expect. Regular sales have the highest average sales price at over $500K and then short sales and foreclosures come in quite a bit lower in the $300K range.

- Days on Market: As we would expect, short sales have the highest number of days on market, in excess of 6 months. Foreclosures had the shortest days on market figure, illustrating the demand for these homes.

- Discounts Off of List Price: Buyers of regular homes saw an average discount off of asking of 7% in Q3. Typically, this has beem closer to 10%, Distressed properties sold for an average of 5% or so off of list price.

If you are interested, you can browse through the previous reports for Scottsdale home sales:

View Scottsdale Home Sales by Type for Q2 2011

View Scottsdale Home Sales by Type for Q1 2011

View Scottsdale Home Sales by Type for 2010

Disclaimer: Due to rounding issues, not all columns will add up to a perfect 100%. Data and information were pulled from the Arizona Regional MLS (ARMLS) as of 10/1/2011 and can change at any time. The analysis looks at single-family resale homes for sale and sales in Scottsdale AZ over the last 12 months. There may be new home inventory in these figures if the developer is using the MLS to market its homes. Information deemed reliable but not guaranteed.

Copyright © 2011 Heather Tawes Nelson

[…] you are interested, you can browse through the previous reports for Scottsdale home sales: View Scottsdale Home Sales by Type Q3 2011 View Scottsdale Home Sales by Type for Q2 2011 View Scottsdale Home Sales by Type for Q1 2011 View […]